More of those incredibly arrogant predictions presented as fact. Let's dissect this line by line

While the first three business days of a year mean diddly in the scope of things, pay attention.

So why are you attempting to draw inference from it further down in your piece by claiming this is what you foresaw? Although interestingly, the first 2 days of 2013 saw better portfolio result claims did they not?

This is precisely the pattern I’ve been telling you for months to expect. Financial assets ascending. Real assets descending. Money surging from bonds to stocks. Commodities squished. And real estate taking it on the chin.

If, in two months, the debt ceiling debacle draws a further US downgrade, and stocks are down 20% again, what then? Oh yes, that's right, "Dont bet against America" : ) We would counter that statement by saying "dont bet against Maths" and of course the Anti -Turner ETF would naturally take opposing positions to what Turner is betting on.

So, your bond fund lost money this week. So did your house in Vancouver. And your silver and gold. In contrast, the S&P 500 (the only US market to watch) rose 4.6% and is now at the highest level since December of 2007. The Dow added 3.8%. Even the Russell 2000, an index of small companies, surged 5.7%, to an all-time crest.

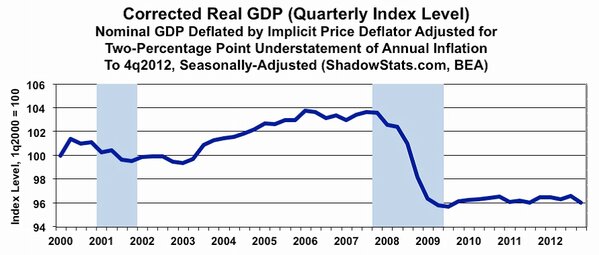

Turner, like many "observers" labors under the delusion that the stock market is an indicator of economic health, rather than the receptacle for excess liquidity driven by dark pools and predatory algorithms.

If true to historical form, he probably wants to buy at all time highs, with seemingly not the faintest idea of the macro drivers and dangers beneath, exactly the same as he has been on every single bubble he has ever "perceived" or not, as the case may be.

If true to historical form, he probably wants to buy at all time highs, with seemingly not the faintest idea of the macro drivers and dangers beneath, exactly the same as he has been on every single bubble he has ever "perceived" or not, as the case may be.

So what does history tell us to do in response to Turner's predictions? Lets run a live test, the Anti-Turner ETF hereby goes tentatively short the Dow & S&P at 13414 and 1462.90 and we will update this to reflect over the position/s over time.

Last year the S&P added more than 13%, despite the fiscal cliff, a US election, the Israel-Hamas war, revolution in Syria, global debt worries and Justin Bieber. Why?

Last year in fact the S&P regained nominal value (to be offset against the devaluing dollar and previous losses) for exactly the same reasons as it always has from the late 90's, and is still firmly within it's previous 10 year trading range.

Because you should never bet against America, where unemployment continues to slowly erode, the real estate market has bounced off bottom, recession talk’s over, Obama romped to re-election and corporate profits surged 11% in the last quarter.

Turner appears to think that with interest rates stuck at the zero lower bound, at which point even the Fed's models predict "explosive inflation" after 8 or 9 quarters, and £85 billion a month in new money printing, this is actually a "recovery". : )

Face it: there’ll not be another 2008. The world will slowly grow out of its debt morass. Bond prices will fall and yields rise. Central bank stimulus will end. Rates will eventually normalize.

Once again, "there will not be.." only the very stupid or the very arrogant, or some combination of both would still be making predictions like this after approaching 30 years of never seeing it coming.

Here's some slightly different analysis, by someone with a proven track record of understanding the situation and being on the right side of the macro trends, for the right reasons over the last decade.

Sprott: “What I found most striking about it is if people really imagined that the Fed was not going to buy bonds, what should happen to interest rates?

" What should happen to the stock market? What should happen to the homebuilders? What should happen to gold?"

This set of basic questions are also in another post but seem relevant to this one so copied across."The only thing that really got smashed (out of those asset categories) was gold and silver...."“The Fed is trying to suck and blow at the same time because they are suggesting the rates are going to stay low out to 2015, unless the unemployment rate gets down. They come out with this statement about the minutes, which means nothing because it’s not policy.”"The Fed doesn’t want gold and silver prices to go up because it would be the indicator that we’re out of control. I’m sure most of your listeners (and readers) know we are out of control. The fact is we spend $4 trillion buying bonds, which is an utter joke, and we’ve accomplished nothing.""We have a recession in Europe, we have minimal growth in the (United) States, we’ve got a recession in Japan, China is kind of kicking along, but all of the countries that have spent the money have accomplished nothing, other than to load up their central bank’s balance sheets."Eric King: “Going back to 2012, when the Fed was saying there would be ‘No more QE,’ of course we were coming out and saying, ‘Of course there will be more QE.’ It was strange, not that the Fed lied, but that they would come out with such a bold lie because it was so ridiculous. Essentially they are doing the same thing here, but it’s different. They are not coming out and saying, ‘We’re not going to do more QE.’ It’s, well, let’s just release some stuff in the minutes and it will basically look like we are going to walk away from QE. It’s the same lie (as 2012) packaged differently isn’t it?”Sprott: “And they try to look like they are responsible, right? It’s the irresponsibility of the central banks that we all have to be aware of. And the fact that they come out with this thing in the minutes and suggest that something might happen, which we all know can’t happen, is to give them some sort of ability to say, ‘Well, we are going to take this way out.’"It’s like the ‘Exit Plan’ as you may recall (from a few years ago). What is the exit plan for the Fed? Well, as you know there is no exit plan. There never was an exit plan, and there is no exit. And it just gets worse all the time.""There’s not a hope in hell that the Fed will not continue to buy the bonds, because who is going to buy the bonds? There is nobody who is going to buy the bonds. Japan can’t buy the bonds, China can’t buy the bonds, Europe and the UK have their own problems. There’s no one left to buy these bonds."Turner as ever, knows better..

Mr Turner, a few questions for you to mull over in those quiet hours of self doubt you have in the middle of the night, that the idiots believe might help your limited understanding of long term macro events.

- Why did you not see the gold run from $1088 upwards? (+51% Jan 10 - date) ..if you could just work out the answer to that..

- What are negative real interest rates? Why are they important?

- What is Shadow banking?

- What is the future significance of open ended Fed stimulus on the USD bond markets?

- What are the implications of a $4 trillion Fed balance sheet at the end of 2013?

- What significance does Japan's imminent negative current account have on global financial outlook?

- Whats significance does Japan's latest open ended commitment to

money printingstimulus have? - What is the significance of the Fed printing enough new money in 2013 to buy 11% of the world's above ground store of gold?

- When the Fed owns the majority of US Govt debt, who could they ever sell to?

- Why are the Chinese amassing Gold at an unprecedented rate?

- What is the significance of the Gold:Oil ratio, and why has it been relatively stable at around 15:1 for 40+ years?

We believe reaching a true understanding in these questions would give you a much better shot at being on the right side of a long term trend moving forwards, rather than running headlong into bursting bubbles every few years. In the meantime, if you could let us know promptly on your blog whenever you capitulate and decide to add more gold to your diversified portfolios?

As on that very day we will be looking to unload some

No comments:

Post a Comment