If you live in Canada, or have any interest in the macro economy and housing bubbles in general, you might possibly have heard of Garth Turner - Canadian housing bubble blogger. Turner is an ex-politician, which in itself, depending on your opinions of politicians, could speak volumes about how much he might be trusted from the outset.

His Wikipedia entry http://en.wikipedia.org/wiki/Garth_Turner does not show much in the way of verifiable fact, probably written by Turner himself, it is prefaced with the statement:

| This biographical article needs additional citations for verification. (April 2012) |

| This article appears to be written like an advertisement. (April 2012) |

The financial section of the entry contains [citation needed] at the end of most sentences, and judging by the mention of libel and multiple edit history, Turner has possibly been complaining about the entry, but if so has seemingly not been able to provide reliable citations requested, to back up his transparently advertorial entry. The page also lists some of his media companies, but carefully skirts around various others, such as:

- Garth Turner's Investment Television

- Real Estate Television;

- Mutual Funds Television;

- DotCom Television (yes, really)

It might appear that wherever there has been a bubble over the years, Turner has been attempting to persuade people into them all, for financial gain in one form or another.

To his credit however, he has managed to effectively leverage his name recognition over the years into a well trafficked blog, (www.greaterfool.ca) where he has been preaching his sermon to the faithful and condemned about the inevitable Canadian housing correction for many years (while all the time prices continued ever-upwards.) Recently, now that his "stopped clock" prediction is finally, after many years starting to look likely, he has taken on a distinctly pompous "told you so" attitude, which includes deleting any comments from his blog that make any kind of real challenge to his financial sales propaganda, or his previous record with financial advice over the years.

To his credit however, he has managed to effectively leverage his name recognition over the years into a well trafficked blog, (www.greaterfool.ca) where he has been preaching his sermon to the faithful and condemned about the inevitable Canadian housing correction for many years (while all the time prices continued ever-upwards.) Recently, now that his "stopped clock" prediction is finally, after many years starting to look likely, he has taken on a distinctly pompous "told you so" attitude, which includes deleting any comments from his blog that make any kind of real challenge to his financial sales propaganda, or his previous record with financial advice over the years.

Although Turner pretends to be on the side of the public, rescuing them from themselves and oncoming real estate train crash, the blog reads like a thinly disguised marketing tool, where he derides anything he does not sell or advise, and pumps his own preferred products continually, throughout blog posts peppered with absolutely certain predictions, presented as facts, apparent only to him, such as this multidimensional corker from August 2012:

- 2012 - "There will be no hyperinflation, government debt crisis, bank collapses or currency crumbles. Every month for the next 60 or beyond, your dollars will buy more real estate, car or computer. The returns everyone expected from just owning a house will be gone, transferred to financial assets." Source

However when one looks back into the past, there are many equally certain, but very wrong calls.

- 1999 - “Financial markets in North America, Europe, Japan, and other places are headed vastly higher. The Dow at 10,000 is just a stepping stone to a market that could achieve 30,000 or even 50,000 by 2015.” Source

- 1999 - “Stocks will be higher in a decade than they are today. Between 1990 and 2000 the Dow went up 500%. Do you really think that between 2000 and 2010 it will go down?” - “10 years from now you should expect stock values to have at least doubled, if not quadrupled.” Source

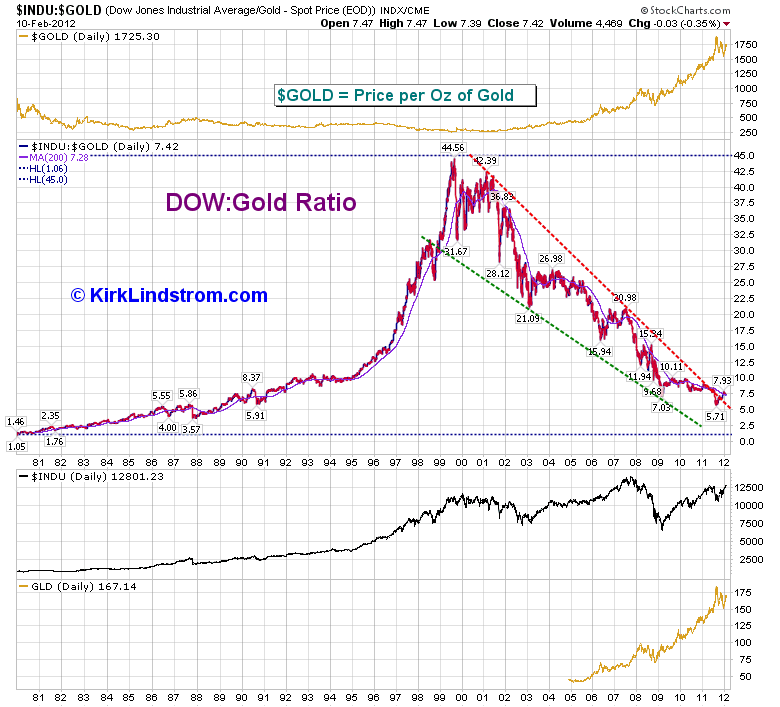

Some might think these charts illustrate a somewhat different picture, and that there has already been a powerful decade plus long wealth transfer underway if you knew where to look. Note: Turner did not.

The DOW:GOLD ratio from 1999 onwards is particularly informative - In fact Turner's bullish DOW prediction caught the EXACT peak in the real value, followed by the market's decade + long decline. Nice market timing, but 180 degrees in the wrong direction.

Markets have at best, stagnated as the money you price them in has lost 30% of it's value. Meanwhile and precious metals have run 500-700+ % - do you think facts like this get discussed very often?

It is our belief that more trust should be put into the opinions of the people who actually understood the significance of events like negative REAL interest rates and told anyone who would listen in 2002. Had you in fact had the foresight possessed by others, like (now Billionaire, and also Canadian) Eric Sprott at the time, and invested your housing deposit into Gold and rented instead, then you could have made good money from this chart, (and potentially even better if real estate does indeed tank hard) because as the chart shows, even as Canadian Real Estate rose into bubble territory, as it is based on some ultimately unpayable housing and consumer debt and negative real interest rates:

Real Estate has, and continues to deflate against real money - Gold (ask the Central Banks)

Source

As we shall show, back at this point in time, Turner was in fact aligning himself with organizations pushing mortgage products, and advising potential "advisees" to leverage up on HELOC debt, to, wait for it, "invest in financial products"

So given his utter arrogance in predicting the future as though nothing else but what he sees could possibly ever come to pass, whilst selflessly helping you with your finances, combined with deleting any real challenges to his wisdom in his domain, and his factually poor prediction success rate (to be explored in depth in future posts) our inherent skepticism of psychics indicates a little historical perspective might be in order. Turner now acts as though he has always been right, and as we shall show moving forwards, in depth on each subject...

Real Estate has, and continues to deflate against real money - Gold (ask the Central Banks)

Source

As we shall show, back at this point in time, Turner was in fact aligning himself with organizations pushing mortgage products, and advising potential "advisees" to leverage up on HELOC debt, to, wait for it, "invest in financial products"

Certainly some of the leverage advice (borrowing to invest) is well beyond the limits of a conservative investment philosophy. I particularly disagree with the illustration that describes a young couple borrowing against a paid up home to invest in mutual funds and then pledging the mutual funds as security for a further investment loan. The scenario suggests withdrawing from the investments to pay the loan interest and writing off the interest expense against income tax. This is where the book fails the reader. It throws out concepts such as these without outlining the potential pitfalls or tax considerations. The write-off figures that he uses are not proven and do not make sense

SourceIt is fairly obvious how anyone following that suggestion over the 2008 precipice might have fared.

So given his utter arrogance in predicting the future as though nothing else but what he sees could possibly ever come to pass, whilst selflessly helping you with your finances, combined with deleting any real challenges to his wisdom in his domain, and his factually poor prediction success rate (to be explored in depth in future posts) our inherent skepticism of psychics indicates a little historical perspective might be in order. Turner now acts as though he has always been right, and as we shall show moving forwards, in depth on each subject...

This might not be the exact facts in evidence..

Turner relies heavily on the fact that many people do not bother go back and check his record over the last 15 years, and indeed much written back then, has now disappeared, as old sites fade and die. Luckily however, using the power of the Internet Archive digging into his past predictions and examination of his financial predictions is still possible (and underway).

Given that in 2002 CBC aired a program looking at Turner's allegedly dubious media activities:

It would appear that most of his business ventures have eventually failed, Xurbia.ca a failed alternative energy brainwave from 2008/2009 amusingly also appears to show Turner going a bit "survivalist" for a spell:

And then there's the whole Credit River business and the bankruptcy controversy, where it doesnt even look like Real Estate was working very well for him in 2007.

Obviously, the point is that nobody knows what the future brings, and most predictions will contain some elements of "right and wrong" and so any credibility assigned should logically be based primarily on a verifiable track record, (current) - internet persona, not so much.

Given Turner's behaviour in silencing any legitimate challenge on his site, is our intention to use the power of the democratic internet ("they who shall be nameless" ;) ) to make the site highly visible in Google, for people to publish their deleted comments on, and for the public to be able to decide the truth for themselves in 2013, based on the facts and (f)actual win rate from his previous psychic episodes.

Given that in 2002 CBC aired a program looking at Turner's allegedly dubious media activities:

..Where he was accused of taking payments for advertorial appearances in several of his Financial media companies, a casual observer might be forgiven for thinking that the blog is just his media business brought into the modern (social media) world.Millennium Media Television (Garth Turner, CEO, produces a number of programs, such as: Garth Turner's Investment Television; Real Estate Television; Mutual Funds Television; DotCom Television; and Board of Trade Television)

It would appear that most of his business ventures have eventually failed, Xurbia.ca a failed alternative energy brainwave from 2008/2009 amusingly also appears to show Turner going a bit "survivalist" for a spell:

What Is Xurbia?

Xurbia is an attitude, a determination. Not urban or suburban, but xurban. Here you can rule more aspects of your environment – the energy you consume, for example.

In Xurbia you’re not helpless and dependent when something fails. When the lights quit or the water stops, you have choices.

In Xurbia, you don’t always need to live by the decisions others make for you. Today, such decisions have brought an unwelcome world. Jobs, homes, assets and people are being devalued. Society is dangerously dependent. Most citizens don’t walk their own path, but many wish they did. In Xurbia, you can.Apparently this was an effort to sell various "Prepper" gadgetry to the scared, much like his financial approach with the blog in fact, although 4 years later Turner is now pretending none of this ever happened and Xurbia is just flogging his tired series of books.

And then there's the whole Credit River business and the bankruptcy controversy, where it doesnt even look like Real Estate was working very well for him in 2007.

Obviously, the point is that nobody knows what the future brings, and most predictions will contain some elements of "right and wrong" and so any credibility assigned should logically be based primarily on a verifiable track record, (current) - internet persona, not so much.

Given Turner's behaviour in silencing any legitimate challenge on his site, is our intention to use the power of the democratic internet ("they who shall be nameless" ;) ) to make the site highly visible in Google, for people to publish their deleted comments on, and for the public to be able to decide the truth for themselves in 2013, based on the facts and (f)actual win rate from his previous psychic episodes.

Internet karma coming your way Turner, Happy New Year

..Oh, and don't bother commenting to attempt to defend yourself, it will of course be deleted.

Turner strikes me as pure "Family Compact". That means elite driven advice with the chutzpah to label such advise as charitable, to those of limited understanding of the system.R. Olausen ,Edmonton.

ReplyDeleteGood description.

ReplyDeleteHe is making it up as he goes along, just like the other pundits. He may be correct about housing, now, 7 years after making the call. The economy is fine, the US is healing, QE is working perfectly, etc. Sell side meme. I had some respect for him until I started to dig around a little and realized how epically bad his investment advice has been. Nortel, Canadian Peso? I think he fancied himself Prime Minister at some point....

I would leave my name, but he lives in my town.....

My girlfriend and I worked with a real estate agent to secure our new apartment and have continued to work with him as he is now our building manager.

ReplyDelete